Dear Reader,

Earlier this week, the University of Liverpool made a dramatic announcement: Researchers have developed a solid state battery electrolyte which matches the performance of traditional liquid electrolyte rechargeable batteries.

Amazing, right? But wait… Doesn’t the current rechargeable battery narrative claim that solid state is already superior in every way, and therefore the heir to the throne currently occupied by traditional Lithium-Ion battery tech?

The answer isn’t quite so simple.

While the promises made are certainly attractive — quicker charging, higher energy density, safer operation, longer lifespan — the drawbacks cannot be ignored.

For one thing, solid state batteries are expensive and complicated to build, making them economically irrational, for now anyway, to implement at scale.

That may sound negative, but it’s a common problem with all new technologies. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Yes… They Lied To You About This Too

Far more concerning is a technical limitation with the entire solid state concept.

In simple terms, solid state is just not as conductive as its liquid alternative — a problem which rarely ever gets mentioned.

And that conductivity problem can get worse depending on the operational environment.

For example, operating it at room or colder temperatures becomes inefficient due to rising resistance — so heating becomes a requirement.

Can you imagine batteries with built in heating elements?

Now, apparently, British researchers have taken a step towards cracking that code, which could open a number of research avenues for improving solid state battery design.

So does this mean that we’re now on the cusp of a revolution (yes, I know, that word again) in the rechargeable battery market?

While my gut tells me that there will be major progress in improving rechargeable battery design in the next 3-5 years, there is also something that will not change.

Not in the next 5 years, and probably not in the next 10.

Lithium Isn’t Going Anywhere Just Yet

Regardless of the nature of the electrolyte, the ions passing through it to effect the flow of charge will still be lithium-based.

That’s another thing that seems to get ignored or at least de-emphasized. Lithium, despite being blamed for all of modern battery shortcomings, isn’t actually the culprit.

Lithium doesn’t make batteries lose charge capacity, get hot, or explode. It’s not the weak link that makes batteries slow to charge or limits its capacity.

Lithium is a unique element — the least dense of all metals — possessing high electrochemical potential which makes it ideal for ionic mobility.

Therefore almost all of the new ideas you hear about when it comes to rechargeable batteries still have lithium as a crucial feature of their core design.

And that means one thing for the lithium market: It’s not going anywhere.

Despite major losses following a tulip-class bubble, lithium demand continues to grow within every major segment of its market.

The Real Lithium Bull Market Is Still Ahead Of Us

Electric vehicles, consumer technology and distributed energy storage will continue to run on lithium for years to come.

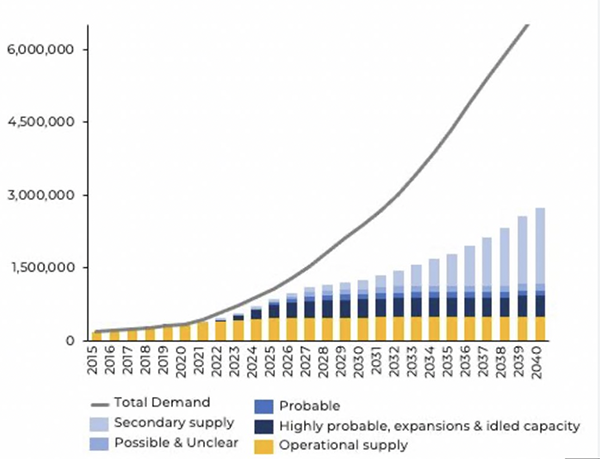

The problem with all this is that supply, unlike demand, isn’t exploding.

In fact, it’s barely rising, and that will become a problem which will boost lithium prices organically (not emotionally as was the case up until last year).

Once that pattern sets in, we could be looking at the strongest resource bull market of the 21st century.

Today, however, prices are still low with lithium trading at almost 75% below the peaks of late 2022.

Which means that today, not tomorrow, is the time to expand your interests in the lithium market.

With so many lithium stocks trading close to 52 week lows, finding something for bargain prices won’t be hard.

This Discovery Could Be Worth More Than The GDP Of Saudi Arabia

But to find the biggest potential winner in this game, you need to look for the biggest discoveries being made today… And there is nothing bigger, anywhere, than the McDermitt Caldera discovery.

Located on the Nevada/Oregon border, the McDermitt Caldera may contain more lithium than the rest of the world’s known reserves put together — up to 40 million tons according to geological analysis.

As the company that owns the property quietly works towards the production stage, its stock, a victim like the rest of the sector, continues to wallow at a tiny fraction of the resource’s potential value.

I’m talking about a market capitalization less than 1/2000 — what all that lithium could be worth on the open market.

It’s potentially the biggest pricing inefficiency I’ve ever seen even at today’s depressed lithium prices.

Want to learn more about it? I would if I were you, because these inefficiencies have a way of working themselves out when you least expect it.

With most of the weak handed speculators now gone from the market, and only the cold-nerved, long-term investors remaining, that return to rationality shouldn’t be much longer.

Check out this presentation on the find at McDermitt Caldera, right now. Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.